When Banks Compete for Customers: The Credit Market on the Brink

Competition fuels lending markets, but it also carries hidden dangers. Banks and fintechs race to attract borrowers with easy terms, fast approvals, and loyalty perks. On the surface, customers celebrate cheaper credit and broader access. Yet beneath the surface, aggressive competition erodes standards. Borrowers accumulate debts across multiple institutions, while banks issue loans with less caution. Growth looks strong in reports, but the foundation weakens. When conditions shift—through inflation, rising interest rates, or job losses—the fragile system cracks. The credit market, once a driver of growth, edges closer to instability.

Why Competition Becomes Risky in Credit Markets

Healthy competition benefits consumers through lower interest rates and new financial products. But in saturated markets, rivalry becomes a race to the bottom. Banks lower credit score requirements, extend larger loans, and emphasize convenience over caution. Borrowers, encouraged by easy access, take on multiple loans without fully understanding repayment obligations. Debt levels rise, often hidden across different institutions. The dynamic creates fragility: lenders fight for growth, borrowers chase quick money, and neither side considers long-term sustainability. When external shocks occur, the system’s weaknesses become visible in waves of defaults and declining bank stability.

The Hidden Trap

Too much competition creates an illusion of prosperity. What looks like growth in loan portfolios often hides systemic risk.

How Banks Lower Standards to Win Borrowers

The mechanics of lowered standards are clear. Banks reduce documentation requirements, making loans faster but less scrutinized. Loan-to-value ratios rise, leaving borrowers with less equity to buffer risks. Pre-approved offers flood inboxes, regardless of changing financial conditions. Marketing campaigns focus on instant approvals, pushing credit as a convenience rather than a responsibility. For a time, loan numbers rise and profits appear healthy. Yet defaults inevitably follow, as many customers cannot keep pace with payments. By then, standards are entrenched, and tightening them without losing clients becomes nearly impossible.

How Standards Have Shifted in Saturated Markets

| Traditional Practice | Current Competitive Practice |

|---|---|

| Strict credit scoring | Lower thresholds for approval |

| Detailed documentation | Minimal paperwork and quick checks |

| Conservative loan-to-value ratios | Higher ratios, more leverage for borrowers |

| Selective targeting | Mass pre-approved campaigns |

The Role of Fintech and New Players

Fintech platforms intensify the competitive race. By promising speed, convenience, and alternative scoring methods, they reshape customer expectations. Traditional banks, fearing loss of market share, match these offerings—even if it means loosening safeguards. Borrowers welcome instant decisions and app-based approvals, but these innovations often bypass traditional checks. The result is a system where ease outweighs caution. Fintechs do not cause risk alone, but they accelerate trends already underway. Their presence forces the entire industry into faster, looser lending practices, amplifying the fragility of already saturated markets.

The Technology Effect

Innovation makes credit easier to access but also easier to misuse. The same speed that delights borrowers can overwhelm risk management systems.

Systemic Risks of Aggressive Lending

The collective impact of lowered standards is systemic. When many banks chase borrowers with loose requirements, risks spread across the financial system. Households carry higher leverage, making them vulnerable to shocks. Rising defaults weaken bank balance sheets, reducing future lending capacity. Economic growth slows as debt burdens stifle spending. Regulators often step in late, by which time portfolios are already saturated with risky loans. The cycle resembles past crises: short-term expansion that unravels when stress tests arrive. The danger is not one reckless lender but an industry-wide shift toward fragility.

Systemic Risks Emerging from Competition

| Risk Factor | Impact |

|---|---|

| High household debt | Increased default risk |

| Weaker lending standards | Fragile bank portfolios |

| Borrower overextension | Reduced consumer spending |

| Regulatory delay | Problems addressed too late |

Narrative Scenario: The Rivalry Spiral

Picture two banks in a competitive market. The first introduces instant mortgage approvals with high loan-to-value ratios. Customers rush in, attracted by speed and size. The second bank reacts, offering even looser terms. Borrowers now juggle large debts from both institutions. For months, profits surge, and executives celebrate success. Then repayment problems surface. Borrowers begin missing payments, defaults rise, and portfolios weaken. The banks, unwilling to show weakness, restructure loans and extend new credit to hide losses. When a downturn strikes, defaults surge across both banks. What began as a rivalry for market share becomes a systemic crisis that spreads through the economy.

The Three-Stage Cycle

- Stage One: Aggressive competition leads to easier credit and rapid growth.

- Stage Two: Borrowers overextend, repayment issues emerge, and banks conceal risks.

- Stage Three: Economic shocks expose fragility, defaults surge, and systemic risk unfolds.

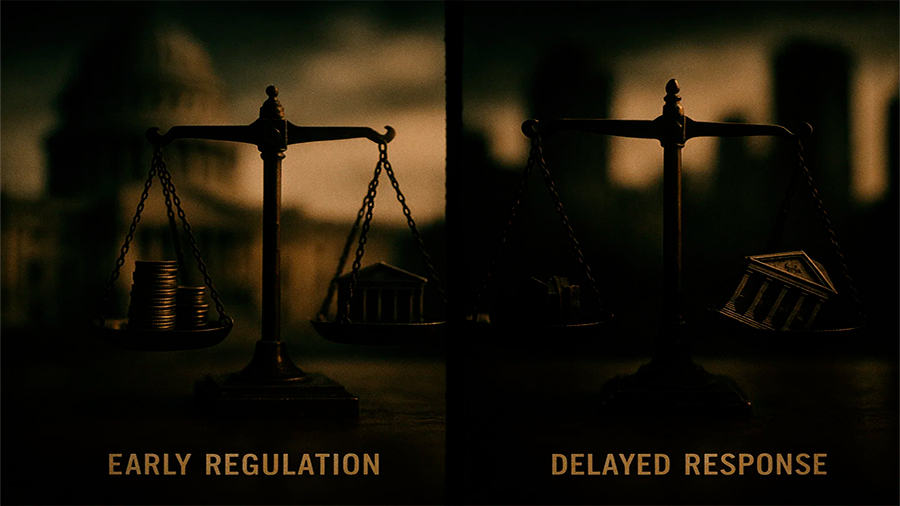

Comparative Example: Early Regulation vs. Delayed Response

Different countries show how timing alters outcomes. In one, regulators stepped in early. Debt-to-income caps were enforced, loan-to-value ratios were limited, and fintech lenders were required to share data with central banks. Borrowers still accessed credit, but within safer boundaries. When a recession hit, defaults rose only slightly, and the banking sector remained stable. In another country, oversight lagged. Competition spiraled unchecked, with easy mortgages and unsecured loans flooding the market. Defaults soared when inflation rose and unemployment climbed. Regulators intervened too late, facing a crisis rather than preventing one. The contrast illustrates that early action builds resilience, while delay deepens fragility.

The Clear Difference

Early enforcement strengthens markets before risks multiply. Waiting until defaults rise means repairing damage instead of preventing it.

Regulatory Challenges and Responses

Regulators must balance innovation with caution. Too much oversight can slow growth; too little encourages recklessness. Tools include caps on loan-to-value ratios, stricter debt reporting, and oversight of fintech lenders. Some governments enforce stress tests to gauge resilience under adverse conditions. The challenge is global: competition in credit markets is rarely confined to one country. Regulators must adapt quickly to shifting technologies and practices. Delayed response magnifies risk, while proactive action keeps markets healthier. The lesson is clear: regulation works best when it anticipates rather than reacts.

Finding Balance

The goal is not to kill competition but to ensure it does not undermine stability. Resilient systems require both innovation and discipline.

Forward-Looking Outlook

The future of credit markets will be shaped by technology, regulation, and borrower behavior. Artificial intelligence promises better risk assessments but can also create blind spots if unchecked. Borrowers will continue to be drawn to easy access, making discipline harder to enforce. Fintech platforms will push banks to adapt faster, often at the cost of thorough risk evaluation. Regulators will likely tighten oversight, introducing tools to prevent the next crisis. The choice for banks is whether to pursue sustainable growth or continue chasing short-term gains. For borrowers, the lesson remains: cheap and fast credit is not always safe credit.

The Future Choice

Credit systems will only remain stable if competition is matched with responsibility. Without restraint, today’s growth becomes tomorrow’s fragility.

Conclusion

Competition keeps markets dynamic, but in lending, too much competition can destabilize the system. Banks lower standards, borrowers overextend, and systemic risks accumulate. Fintech accelerates these trends, while regulators struggle to keep up. The narrative of rival banks shows how aggressive lending spirals into crisis. The comparative example proves that timing matters: early regulation stabilizes, delay invites collapse. The credit market may continue to grow, but its resilience depends on discipline. Stability comes not from endless lending, but from balancing innovation with responsibility.

Daniel Reed is the founder and chief editor of MYA App. With more than 12 years of experience in finance, economics, and digital markets, Daniel brings a unique perspective to complex topics such as credit risks, global auctions, and investment strategies.

Daniel Reed is the founder and chief editor of MYA App. With more than 12 years of experience in finance, economics, and digital markets, Daniel brings a unique perspective to complex topics such as credit risks, global auctions, and investment strategies.